Google Ads Competitor Analysis Guide Mastery

Google Ads Competitor Analysis Guide Mastery

If you run Search or Shopping campaigns for any length of time, you learn two truths fast: competition is constant, and Google’s auctions reward those who read the field well. Competitor analysis is not about copying your rivals. It is about seeing what the auction is telling you, spotting patterns they create, and using that insight to make sharper moves.

Good news: you already have most of what you need inside your Google Ads account. Add a small stack of external tools, a clear cadence, and a simple decision framework, and you’ll turn fuzzy hunches into actions that move impression share, cost per click, and profit.

Start with the mindset that wins auctions

Clicks are the output. Attention is the prize.

When you study competitors, focus on where they get attention, when they step in or step out, and why their message lands. That means you care about share of voice metrics, the timestamps on those shifts, and the promise their ads and landing pages make.

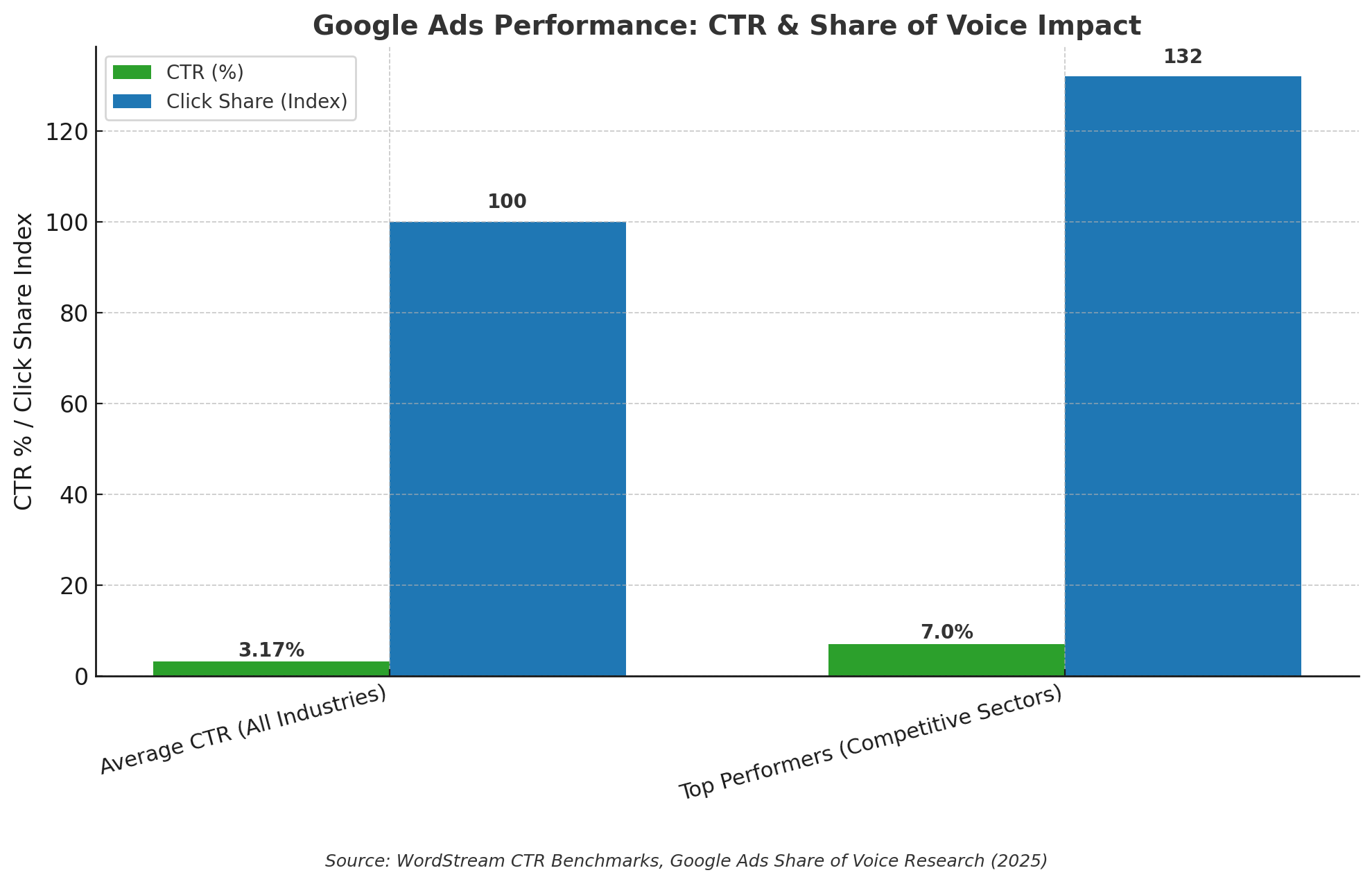

Once you view the field that way, Google’s native surfaces start to sing. In fact, research shows that brands with a higher share of voice on Google Ads capture up to 32% more clicks compared to their competitors. According to WordStream, the average click-through rate (CTR) for Google Ads across all industries is around 3.17%, but top performers in competitive sectors often achieve CTRs above 7%. This gap is driven by strategic timing, compelling messaging, and a deep understanding of when and where to appear.

By analysing competitors’ ad schedules and creative shifts, you can spot opportunities to outmanoeuvre them—whether that’s bidding more aggressively during peak hours or crafting landing pages that resonate more deeply with your audience. The data is clear: brands that monitor and adapt to these competitive signals consistently outperform those who don’t. In the world of Google Ads, attention isn’t just won—it’s engineered.

What Google already tells you about competitors

Think of these as your always-on radar.

- Auction Insights: shows who appears alongside you and who wins rank or top-of-page more often.

- Ad Preview and Diagnosis: safe, real-time SERP snapshots by keyword, location, and device.

- Merchant Center Competitors (Shopping): comparative visibility and position signals for similar retailers.

- Ads Transparency Center: a searchable library of verified advertisers’ active and recent ads.

- Keyword Planner: infer competitor themes by entering their domain and reviewing suggested terms.

Auction Insights that actually inform decisions

You’ll see:

- Impression share: your slice of eligible impressions

- Overlap rate: how often you and a named competitor appear together

- Outranking share: how often one of you outranks the other when both show

- Position above rate, top-of-page rate, absolute top-of-page rate

How to read these:

- High overlap + they outrank you often: raise bids if profitable, lift quality signals, sharpen ad relevance, and check landing page speed and intent match.

- You outrank them but your impression share is low: test slightly lower bids to win more auctions at a tolerable position, or raise budget caps if you’re hitting limits.

- Segment by device, day, and hour: you’ll often find soft spots like a rival going quiet on weekends or on mobile. Push in those windows.

Tip: track these metrics at the ad group or keyword label level for your top revenue drivers, not only at campaign level.

Ad Preview and Diagnosis for live creative intelligence

Search your priority terms by suburb, region, or country and by device. Log:

- Headlines, descriptions, and extensions

- Offer language and CTAs

- Sitelinks, prices, and promos

- Landing URLs

This is your living swipe file. Refresh it often and treat it as a source of A/B test ideas.

Merchant Center’s competitor panel for Shopping

If Shopping matters to you, the Competitors view shows relative visibility, page overlap rate, and higher position rate across similar products. Watch for:

- New merchants gaining share in your category

- Seasonal jumps in higher position rate from particular sellers

- Products where your visibility lags the market

Feed quality, pricing, and shipping promises show up here quickly.

Ads Transparency Center for scale and themes

Search your competitors’ brand names using the Ads Transparency Center and browse their search, display, and video ads. Note:

- Volume of active ads, frequency of new variants

- The themes they repeat across formats, like price guarantees, setup time, or sustainability

- Whether they invest in video or keep to text and static display

The aim is not to copy, but to spot what they believe drives demand right now.

Keyword Planner to infer their intent targets

Drop in a competitor domain and capture suggested keywords with volume, competition, and top-of-page bid ranges. Tag each by intent using Google Keyword Planner:

- High intent: brand + product, pricing, near me

- Mid intent: feature + use case

- Early intent: category and problem terms

Now compare that map to your coverage and find gaps worth testing.

Find the rivals who actually matter

Not every domain in Auction Insights is a true rival. Segment your list:

- Direct: same product or service, same audience

- Indirect: substitutes or adjacent solutions

- Niche: focused on a subset of your market

- New entrants: limited footprint but growing fast

- Brand bidders: appear on your brand terms

To separate real competitors from noise, start by mapping overlap in impression share and keyword targeting. According to Google, domains with a consistent impression share above 10% on your core keywords are likely to be your true competitors. Use Auction Insights to track which domains show up most frequently alongside your ads, especially on high-intent, bottom-of-funnel keywords.

Direct competitors are those whose ads appear on the same transactional queries and whose landing pages mirror your offer, pricing, and value proposition. For example, if you sell accounting software and another domain consistently appears on “buy accounting software” and “best accounting software for small business,” that’s a direct rival. Indirect competitors might target broader or alternative solutions, such as “business finance tools” or “invoicing apps.” Niche players may only appear on long-tail, highly specific queries, but can command strong loyalty within that segment.

Brand bidders are easy to spot: filter Auction Insights for your branded terms and see who’s bidding. According to SEMrush, over 40% of brands experience competitors bidding on their brand keywords, which can drive up your CPC by as much as 30%.

Keep a simple worksheet with columns for brand, offer focus, core USPs, and the keywords where you cross paths. Update this monthly, noting shifts in impression share, new entrants, and changes in ad messaging. This disciplined approach ensures you’re not just reacting to noise, but tracking the players who actually impact your market share and ad performance.

By focusing on domains with high impression share overlap, similar ad copy, and landing pages targeting your core audience, you can confidently identify your true competitors—and allocate your budget and strategy where it matters most.

Turn signals into tactics

Information without action is noise. Here is a clean way to translate common patterns into moves.

- When a competitor dominates impression share on a high-value term

- Increase max CPC to reach your target impression share, but gate it by ROAS or CPA

- Improve ad strength and extensions to lift quality

- Tighten match types and negatives to keep efficiency

- When your outranking share is strong but you see low impression share

- Test a small bid reduction to pick up more auctions at a slightly lower position

- Raise daily budget if Lost IS (budget) is high

- When a rival goes quiet by hour or device

- Add dayparting and device multipliers to flood the zone during their off-hours

- When ad copy reveals an offer trend

- Rapidly test that promise in your own language: fast shipping, local support, price match, longer trials

- Bring the same promise above the fold on the landing page

- When you spot brand bidding against you

- Ensure you sit at the top on your own brand terms

- Use sitelinks and callouts to crowd out the screen

- Monitor quality and relevance to keep CPCs low on brand

Third-party tools that fill the blind spots

Google’s view covers auctions where you appear. External platforms add historical context, cross-market keywords, and spend estimates. Use at least one search-intelligence tool and, if display or YouTube matter, one creative-intelligence tool.

| Tool | Core strengths | Best used for |

|---|---|---|

| SEMrush Advertising Research | Paid keywords, ad history, position charts, spend estimates | Keyword gaps, market over time, quick ad copy exports |

| Ahrefs Site Explorer (Paid) | Paid keywords, ads and landing pages, traffic and CPC estimates | Landing page mapping, long-tail term discovery |

| SpyFu | Deep PPC history, long look-back, ad variants, budget guesses | Seasonality and long-run competitor patterns |

| iSpionage | Campaign watch, near real-time alerts, landing URLs | Monitoring active keyword and copy changes |

| Similarweb | Category-level paid traffic share and CPC patterns | Benchmarking budget aggression and traffic share |

| AdBeat or Moat | Display and video creative libraries | Creative patterns outside search |

Use estimates carefully. Treat them as directional, then confirm what you can in your own account.

What this data cannot tell you

Good strategy respects the limits of the instruments.

- Partial visibility: You only see auctions you share with others. According to Google, Auction Insights only includes domains that participated in the same auctions as you, meaning entire competitor segments may operate outside your view—especially if they target different geographies, devices, or keyword sets.

- Activity thresholds: Low-volume terms may not surface in reports. Google’s documentation notes that Auction Insights requires a minimum level of activity to display data, so niche or long-tail keywords might be underrepresented, potentially hiding emerging threats or opportunities.

- Relative metrics: Impression share and outranking share provide directional insights but not exact spend or bid data. WordStream highlights that impression share is a percentage of possible impressions, not a direct measure of budget or aggressiveness, making it essential to interpret these metrics in context.

- Timeliness: UI reports often aggregate over days or weeks, which can obscure rapid shifts in strategy. The Google Ads Transparency Center, launched in 2023, shows recent ads but not every creative variant or historical campaign, limiting your ability to track long-term trends or A/B test cycles.

- Policy and definitions: Some ad types or networks are excluded from reports. For example, Discovery and Performance Max campaigns may not appear in Auction Insights, as confirmed by Google’s support documentation, meaning you could miss competitors investing heavily in these formats.

To fill these gaps, run your own controlled tests—adjust bids, launch new creatives, or shift geotargeting—and let your performance data validate or challenge your assumptions. According to a 2024 Search Engine Journal survey, advertisers who regularly test and iterate campaigns see up to 27% higher conversion rates than those who rely solely on platform reports. In short, use platform data as a compass, but let your own experiments chart the course.

Keep it fair and above board

A short code of conduct keeps your team safe and focused.

Do:

- Use Google’s native tools, public ad libraries, and approved third-party platforms

- Review competitors’ visible ads and landing pages

- Record insights and turn them into tests

Don’t:

- Click competitors’ ads to drain budgets

- Scrape private data or create fake accounts

- Violate platform terms or privacy laws

The aim is simple: learn fast, compete hard, win clean.

A monthly workflow that compounds

Build a rhythm your team can sustain. Here is a practical template.

- Baseline the field

- Run Auction Insights for top campaigns and key labels

- Segment by device and day to find pattern shifts

- List the top five competitors by overlap for each cluster

- Map creative and offers

- Use Ad Preview to capture SERPs for 10 to 20 core queries by location and device

- Pull each main rival’s ads from the Transparency Center and tag by theme

- Expand the keyword view

- Run a competitor domain in Keyword Planner for suggested terms and top-of-page ranges

- Use a third-party tool to export their paid keywords and find gaps vs yours

- Inspect landing experiences

- Open the landing pages used by rivals in their ads

- Log trust signals, framing, hero copy, and conversion paths

- Decide and test

- Pick three bid or schedule changes, three ad tests, and one landing improvement

- Set budgets and guardrails, define primary metrics and timeframes

- Report and archive

- Update a simple monthly dashboard with impression share, outranking share, top-of-page rate, and active ad count by competitor

- Keep a change log of your moves and the results

Repeat next month. Keep what works. Drop what doesn’t.

The few KPIs that matter most

You can track a lot. Start with the set that reflects competitive posture and profitability.

- Share of voice signals

- Impression share on priority clusters

- Overlap rate against top rivals

- Outranking share and top-of-page percentages

- Efficiency and outcome signals

- CPC trend on contested terms

- CTR change after copy tests

- Conversion rate and ROAS per cluster

Pair quantitative metrics with a short qualitative note: what did competitors change this month, and how did we respond?

AI-powered shortcuts you can trust

Smart use of AI saves hours without dulling your judgement.

- Turn exports into insights: feed a list of competitor keywords or ad headlines into an LLM and ask it to group themes, spot gaps, and draft alternative headlines for testing

- Summarise landing pages: paste key content blocks and request a list of value props, risk reversals, and social proof elements

- Anomaly alerts: set scripts or tool alerts for sudden drops in your impression share or spikes in competitor overlap

- Forecast hotspots: use pattern history to predict when rivals crank bids around sales periods, then prepare your bid rules and budgets

Treat AI as your analyst. You remain the strategist.

From signals to systems: an actionable playbook

Put all of this together and you have a system that steadily improves your position in the auction. Here is a tight, repeatable approach you can implement now.

- Build your competitor set

- Direct, indirect, niche, brand bidders

- Top five by overlap per core keyword cluster

- Instrument your view

- Saved Auction Insights views by device and time of day

- A SERP capture routine in Ad Preview

- Monthly Transparency Center scan for each main rival

- Create your shared files

- Swipe file of ad copy and extensions

- Keyword gap sheet with intent tags and cost ranges

- Landing page pattern board with notes on proof and friction

- Decide like a trader

- Raise bids where payback is proven and share is at risk

- Shift budget into time windows where rivals retreat

- Test one strong new promise in copy each fortnight

- Match the promise on-page with friction cuts and proof

- Review and refine

- One-page monthly summary: who gained, who lost, what changed, what we shipped

- Keep a changelog with dates, actions, results, and next steps

A 30-day plan to lift your edge

Week 1

- Run Auction Insights deep dives on top three revenue clusters

- Capture 30 SERP previews across cities and devices

- Pull competitor ads from the Transparency Center and tag themes

- Identify five keyword gaps with business fit and cost tolerances

Week 2

- Launch two ad tests based on competitor promises

- Raise or lower bids on three keywords per cluster based on outranking and impression share

- Improve one high-traffic landing page with proof and clarity drawn from your pattern board

Week 3

- Add dayparting and device adjustments where rivals go quiet

- Expand into two gap keywords per cluster with tight match types and negatives

- Set up alerts for impression share drops and new competitor entrants

Week 4

- Review outcomes: CTR, CPC, impression share, and conversions by cluster

- Keep the winners, pause the losers, and line up the next two ad tests

- Update the dashboard and archive this month’s creative and landing page learnings

Repeat next month with the same cadence, and you will notice a stronger presence where it matters, steadier costs where it counts, and a team that makes faster, smarter calls.